Dr. John Lott has a new op-ed piece at RealClearPolitics. Also at Hotair.com and World Net Daily.

.

Democrats keep claiming that Trump “gave away” $40 billion to Argentina, and many people are understandably upset. How, they ask, could the United States hand over money to a foreign country?

.

The problem is simple: the claim isn’t true. The U.S. didn’t give Argentina money. It entered into a currency swap – and the U.S. has actually earned a profit on the transaction.

.

Senate Minority Leader Chuck Schumer (D-NY) insists that “the administration is giving this money away to help Argentina’s hard-right president.” He argues, “If this administration has $20 billion to spare for a MAGA-friendly foreign government, how can they say we don’t have the money to lower health-care costs here at home?” Congressman Ro Khanna similarly warned, “It’s shameful that we gave $40 billion to Argentina instead of spending $9 billion to feed American families.”

.

Other Democrats, such as Senators Amy Klobuchar (D-MN) and Elizabeth Warren (D-MA), describe the transaction as Trump “sending” money to Argentina and even call it a “bailout.” Fifty-four Democratic House members lodged the same complaint.

.

News outlets, such as The Washington Post, pushed the claims with headlines like “The U.S. just bailed out Argentina.”

.

But the U.S. didn’t give Argentina anything. It conducted a currency swap: The U.S. provided dollars, and Argentina provided an equal value in Argentine pesos. Saying we sent money to Argentina ignores a crucial fact: Argentina sent money right back to us at the same time.

.

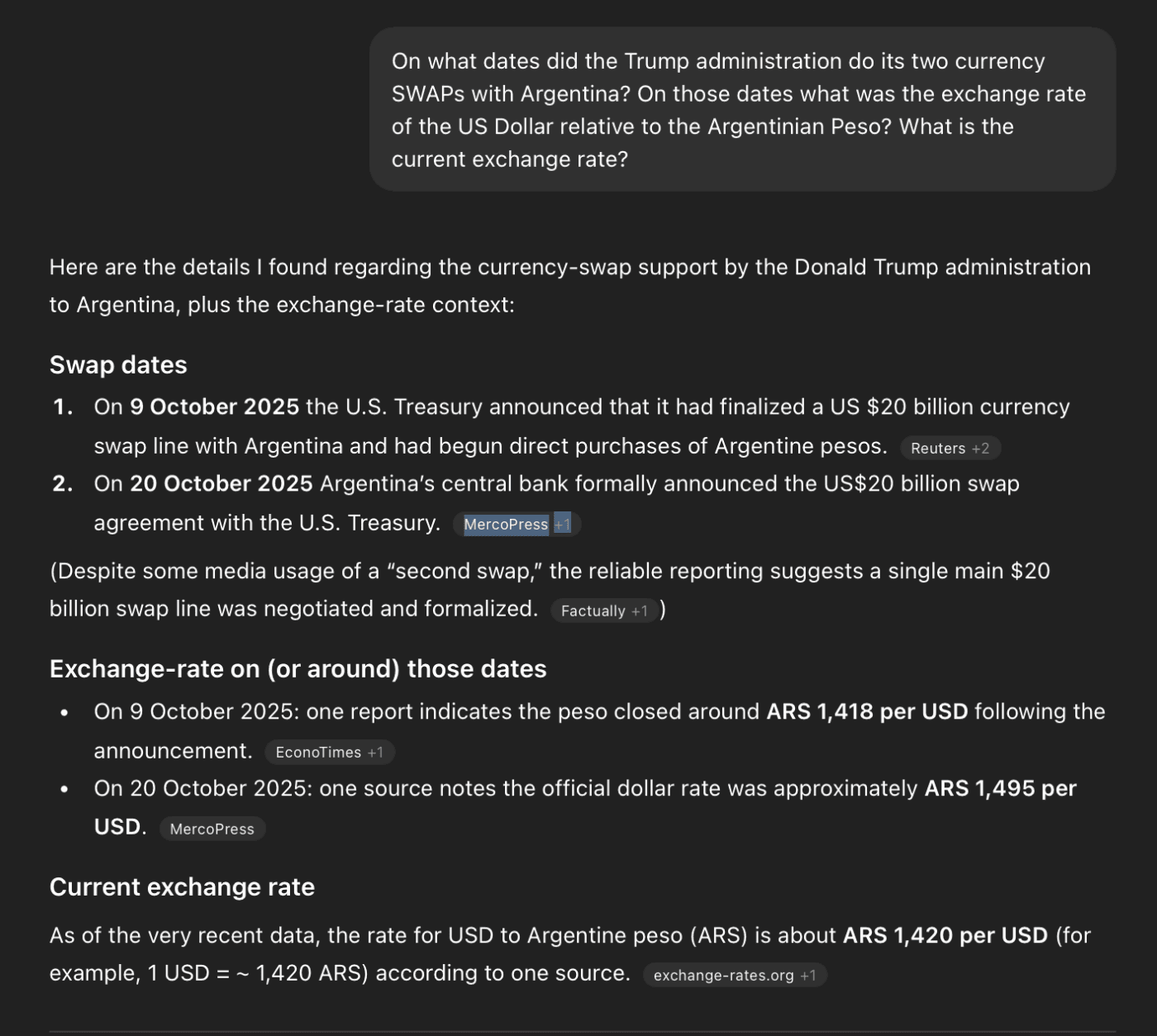

The first $20 billion swap occurred on Oct. 9, 2025, when the exchange rate was 1,418 pesos per dollar. The second $20 billion swap followed on Oct. 20 at an exchange rate of 1,495 pesos per dollar. By Nov. 12, the rate had moved back to 1,420 pesos per dollar. So, on average, the pesos we got in exchange for the dollars were worth more now than when we bought them. As a result, the U.S. now holds more than $41 billion in value from the original $40 billion, yielding an impressive 2.6% return in just one month.

.

That gain outperforms the 1.7% return the same funds would have earned in the S&P 500 over the same period.

.

Treasury Secretary Scott Bessent, who negotiated the arrangement, predicted this outcome. With decades of experience as a remarkably successful currency trader, Bessent recognized the opportunity for the U.S. to stabilize a key partner while making a profitable financial move. This week, he publicly confirmed the result: “The U.S. government made money.”

.

But the swap didn’t just help the United States. It also helped Argentina during a politically sensitive moment. As Bessent explained on MSNBC, “We used our financial balance sheet to stabilize the government, one of our great allies in Latin America, during an election.” The swap provided breathing room for Argentina’s financial system, helped calm market volatility, and supported the peso. That stabilization, in turn, improved the value of the pesos the U.S. now holds – exactly the outcome an experienced trader like Bessent would expect.

.

In the end, the arrangement accomplished two goals at once: The U.S. earned a profit, and it supported a democratic response to economic pressure. There was no handout, no bailout, and no giveaway. The U.S. simply exchanged assets that were initially equal value. It was a strategic financial transaction that benefited both countries – and made U.S. taxpayers some extra money.

.

John R. Lott, Jr., “The Truth About Argentina’s ‘Bailout’,” Real Clear Politics, November 14, 2025.

0 Comments